Struggling with debt can feel like an uphill battle, but effective budgeting methods like the 50/30/20 rule can help you take control of your finances. This popular budgeting strategy simplifies your financial planning, making it easier to manage your income, control spending, and focus on reducing debt.

In this blog, we’ll explain how the 50/30/20 budgeting rule works, its benefits, and whether it’s the right approach to help you become debt-free faster.

What Is the 50/30/20 Rule?

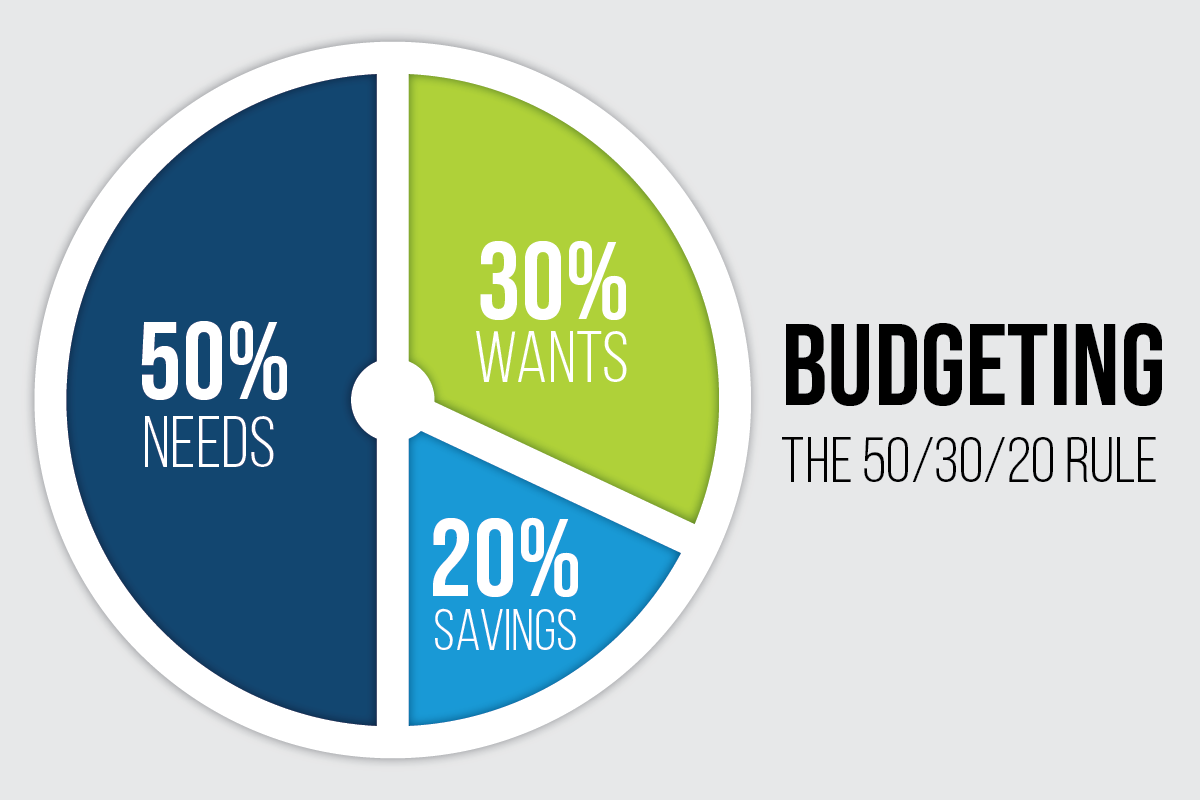

The 50/30/20 budget rule is a straightforward method to allocate your after-tax income. It divides your money into three main categories:

- 50% for Needs: These include non-negotiable expenses necessary for daily living, such as:

- Rent or mortgage payments

- Utilities and insurance

- Groceries and transportation

- Minimum debt payments (credit card bills, student loans, or car loans)

- 30% for Wants: This category allows room for discretionary spending, such as:

- Eating out or entertainment subscriptions

- Vacations and hobbies

- Non-essential shopping or lifestyle upgrades

- 20% for Savings and Extra Debt Repayment: This portion is crucial for building financial security and reducing debt. It covers:

- Emergency savings

- Retirement accounts or investment contributions

- Paying off debts faster by making extra payments

This rule is a simple but effective way to budget for debt repayment while maintaining a balanced financial lifestyle.

How Does the 50/30/20 Rule Help with Debt Management?

Applying the 50/30/20 budget can significantly impact your ability to manage and pay down debt. Here’s how:

1. Prioritizes Essential Payments

The 50% needs category ensures you first focus on covering life’s essential expenses, including the minimum payments on your debts. Staying current on your payments prevents late fees and helps protect your credit score.

2. Builds Momentum with Debt Payments

The 20% allocation for savings and debt repayment allows you to channel extra funds toward clearing your debt faster. Making extra payments, particularly toward high-interest loans or credit card balances, can save you money in interest and accelerate your path to financial freedom.

3. Keeps Lifestyle Inflation in Check

One common financial pitfall is spending more as income rises, often called «lifestyle inflation.» Limiting discretionary spending to 30% of your income helps prevent this, ensuring more money is available for debt repayment and long-term goals.

4. Encourages Savings for Emergencies

Unexpected expenses can derail your debt repayment plans if you’re not prepared. The 50/30/20 rule includes saving for emergencies as part of the 20%, giving you a financial cushion to avoid taking on more debt.

5. Simplifies Financial Decisions

The structured approach of the 50/30/20 method removes guesswork. It’s easier to plan your monthly finances when you know exactly how much to allocate for needs, wants, and savings.

How to Use the 50/30/20 Rule to Pay Off Debt

Here’s a step-by-step guide to applying this budgeting method for effective debt management:

1. Calculate Your Monthly Income

Start by determining your take-home pay after taxes. Include all income sources, such as salaries, freelance work, or passive income.

2. Break Down Your Expenses

Divide your current spending into the three categories:

- Needs (50%): Include rent, utilities, groceries, insurance, and minimum debt payments.

- Wants (30%): Add expenses like dining out, entertainment, and subscriptions.

- Savings/Debt Repayment (20%): Include extra debt payments and emergency savings.

3. Adjust as Needed

If you’re overspending in certain areas (e.g., «wants»), reduce those costs and redirect the savings toward debt repayment or building an emergency fund.

4. Focus on High-Interest Debt

Use the 20% savings and debt repayment allocation to tackle high-interest debts first, like credit cards, using the debt avalanche method. Alternatively, you can prioritize smaller debts with the debt snowball method for quicker wins.

5. Track Your Progress

Regularly review your budget and spending habits. Use budgeting tools like Mint or YNAB to stay on track.

Benefits and Drawbacks of the 50/30/20 Rule

Benefits

- Clear Structure: Simplifies budgeting for debt management.

- Financial Balance: Balances debt repayment, essential spending, and savings.

- Adaptability: Works for various income levels and financial goals.

Drawbacks

- Not Ideal for Heavy Debt: If your debt repayments exceed 20% of your income, you may need a more aggressive approach.

- Overly Generalized: Doesn’t account for unique financial situations like medical debt or irregular income.

Optimizing the 50/30/20 Rule for Debt Freedom

For those with significant debt, consider modifying the 50/30/20 rule to focus more on debt repayment. For example:

- Adjust the allocation to 50/20/30, where 30% goes to savings and debt repayment.

- Temporarily reduce spending on «wants» to free up funds for faster debt elimination.

Pair this method with additional strategies, such as debt consolidation or negotiating lower interest rates, to maximize its effectiveness.

Is the 50/30/20 Rule Right for You?

The 50/30/20 rule is a great tool for those starting their journey toward better financial health. If you have moderate debt and want a manageable, well-rounded approach to budgeting, this method can help you make steady progress.

However, if you’re facing significant debt, combining this rule with aggressive repayment strategies like the debt avalanche or snowball methods may yield faster results.

Take Control of Your Debt Today

By implementing the 50/30/20 budgeting rule, you can simplify your finances, prioritize essential expenses, and build momentum toward paying off debt. Whether you’re just starting your journey to financial freedom or looking for a better way to balance your budget, this rule can be a powerful tool.

Ready to take the first step? Start today by evaluating your expenses, creating a 50/30/20 budget, and focusing on consistent debt repayment. Your path to financial freedom is closer than you think!

Deja una respuesta